The 5 Core Pillars of Sales Enablement in Financial Services

![]() Rahul Mathew

on

July 31, 2023

Rahul Mathew

on

July 31, 2023

In the highly competitive financial services industry, effective sales training is a game-changer.

Sales reps are crucial in promoting and selling financial products and services to a diverse customer base. To achieve success in this field, a well-trained salesforce that can communicate the value and benefits of the products they represent is essential.

Let’s consider some stats.

Percentage of time spent actively selling

Increase in win rates with coaching investments

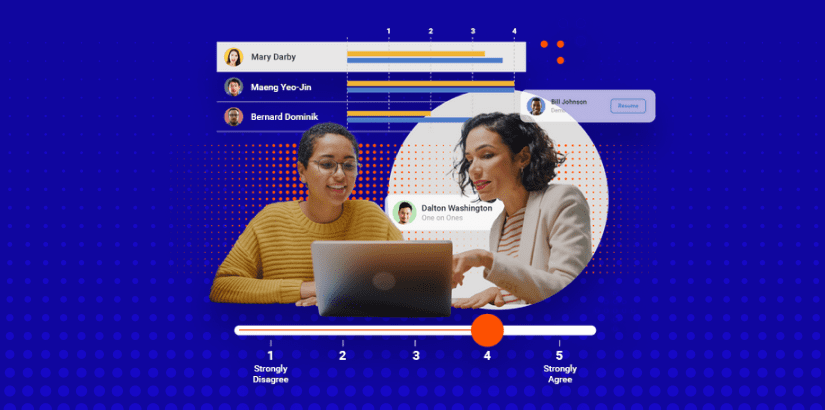

Companies that don’t prioritize sales enablement see their reps spend just 36% of their time actively selling or even less. The average rep at these organizations spends more than nine hours each week searching for and customizing content alone. Conversely, companies that invest in coaching programs see an 8% increase in win rates.

The revenue and risk reduction impact of implementing best-in-class training is enormous for the average financial services organization.

In this blog post, we’ll outline the unique challenges faced in financial services sales training and provides practical solutions to excel in this critical area.

What we’ll cover:

- Unique training challenges financial services companies face

- Top use cases including

Onboarding and ramping new reps fast - Enabling reps on new products & regulatory requirements quickly

- Scaling role-plays to practice before reps are in the office

Providing data-driven micro-coaching - Improving rep coverage with data-driven insights

- DOs and DON’Ts of selecting a technology partner

Unique training challenges financial services companies face

In recent years, the financial services industry has been significantly disrupted by the shift from in-person to online and digital training programs. As fewer than 20% of financial services employees look to be in the office more than three days a week, it’s increasingly difficult for employees to keep up with new regulatory changes and technologies.

Some of the top challenges financial services enablement teams face include:

Traditional sales managers find it difficult to gain visibility into the daily activities of their account managers and sales representatives in the field. This lack of insight makes it challenging to provide timely feedback, identify coaching opportunities, and assess the effectiveness of sales strategies.

The financial services industry offers a wide range of products, each with its unique features and benefits. Onboarding and ramping up new sales representatives quickly and effectively, ensuring they have a comprehensive understanding of the product portfolio, can be a significant challenge.

he COVID-19 pandemic drastically reduced the amount of face-to-face time sales representatives have with prospects and clients. This shift to virtual interactions requires sales training programs to adapt and equip representatives with the skills needed to engage effectively in a digital environment.

The financial services industry is subject to strict regulatory guidelines. Sales representatives must be trained to ensure they adhere to these requirements in their interactions with prospects and clients. With compliance requirements changing regularly, financial services companies must ensure their field team has the most up-to-date versions of collateral.

5 pillars to excel in financial services sales training

In this section, we will delve into the key strategies that enable financial services companies to excel in sales training and empower their reps to thrive in this highly competitive industry.

- Utilize technology-driven training solutions such as e-learning platforms and virtual training sessions to provide comprehensive information on products, services, compliance, and selling techniques.

- Incorporate interactive modules and quizzes to assess knowledge retention and ensure new reps are well-prepared to engage with buyers and clients.

- Utilize online training modules, just-in-time content, and virtual workshops to disseminate information on new products and regulatory requirements quickly.

- Have a centralized and searchable platform for training and enablement, ensuring reps have access to up-to-date information anytime, anywhere.

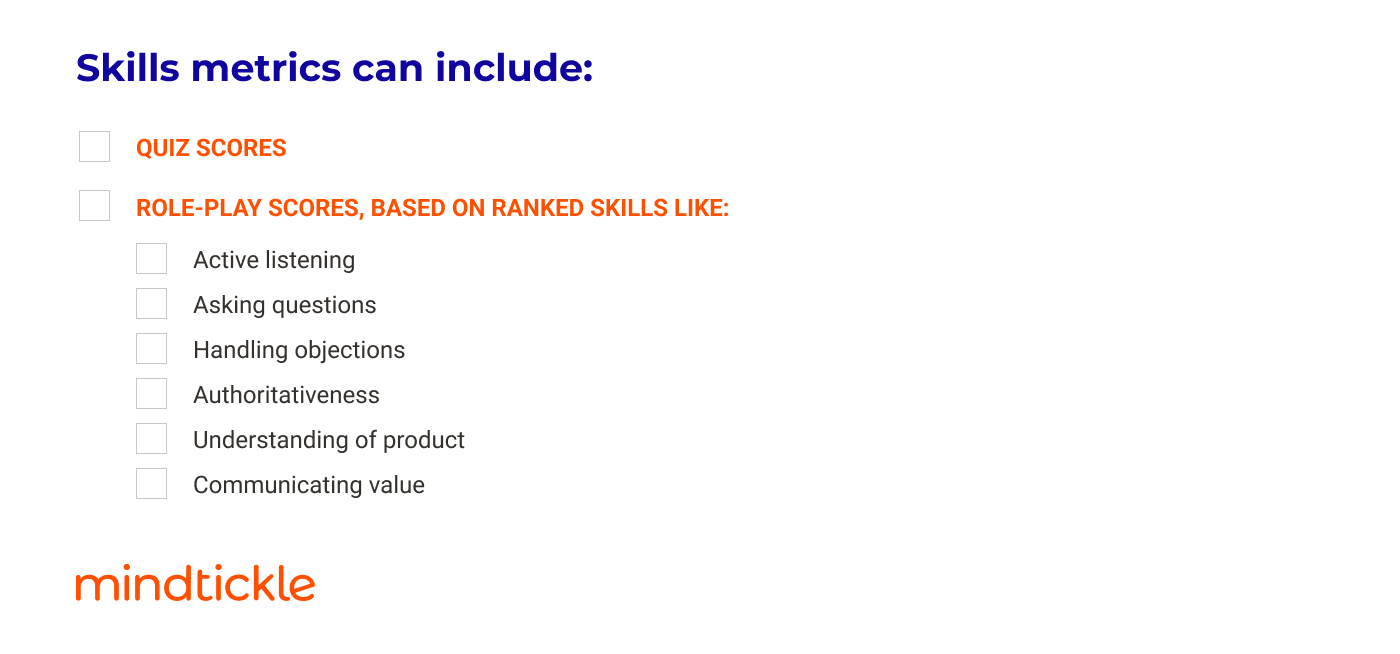

- Use AI-reviewed role-play exercises to enhance communication skills and refine product pitches.

- Allow reps to practice presentations, handle objections, and refine selling techniques remotely, ensuring they gain experience and confidence before engaging in the field.

- Utilize sales training platforms to access data on reps’ activities, behaviors, and in-field performance.

- Leverage new technologies like revenue and conversation intelligence to provide targeted, data-driven coaching to reps.

- Gather data on sales representatives’ activities, call frequency, territory coverage, and buyer engagement levels to make data-driven decisions.

- Integrate sales training platforms with CRM to analyze the effectiveness of training programs in driving business results.

DOs and DON’Ts of selecting a financial services enablement provider

Now let’s dig into the essential dos and don’ts of selecting a sales enablement provider for your financial services organization. Making the right choice when it comes to partnering with a sales training provider can significantly impact the success of your sales team and overall business performance.

DOs

- Define your requirements and the capabilities and resources you need.

- Evaluate the provider’s financial services experience through case studies, references, and reviews.

- Assess the provider’s technology for user-friendliness and integration capabilities.

- Consider the quality and delivery of training and support.

DON’Ts

- Choose a provider solely based on price.

- Overlook the importance of user experience in the training platform.

- Neglect to evaluate the provider’s ability to customize the platform to your organization’s unique needs.

- Fail to consider the provider’s customer support and training resources.

What’s next for your org?

Implementing these five pillars will enable your organization to drive revenue productivity and achieve sales training excellence in the financial services industry.

Ready to learn more about how Mindtickle can help your organization? Set up time with our team to learn more about how financial services organizations can stand up sales enablement programs that drive more productivity and revenue.

Supercharge your enablement

Set up time with the Mindtickle team to talk through how helps other financials services orgs stand up their enablement programs.

Request a Demo